*** Read our most recent blog post on the latest Warehousing Trends: Warehouse Automation Trends for 2025: 25 Expert Thoughts ***

Updated November 12, 2024

A recent warehouse automation report from Kardex Remstar features responses from more than 200 warehouse and distribution center professionals across a variety of industries. It provides detailed insights into warehouse automation and what lies ahead for 2024. The persistent labor shortage, ongoing supply chain interruptions, rising freight costs and the fear of running out of physical space will remain as top issues in the order fulfillment and distribution operations space in 2024. Organizations are also worried about meeting their customers’ demand for faster delivery times, how to effectively process returns and data visibility across multiple locations. Let's dig into the details!

As labor, materials and shipping costs continue to put pressure on companies’ bottom lines in 2024, more warehouses continue to turn to technology, automation and robotics to streamline their order fulfillment processes, reduce costs and compete more effectively. They’re also making better use of vertical space and using space-saving equipment like automated storage and retrieval (AS/RS) systems to improve efficiency and further reduce costs.

Curious about Warehouse Automation? Dive into what it is and how it can help your warehouse here: ASRS 101: Automated Storage and Retrieval Systems

Top Warehousing Goals

As companies look into the horizon, key objectives align with bolstering overall operational efficiency. A notable percentage are prioritizing error reduction and enhanced order accuracy, while an equivalent percentage seeks higher productivity levels. Companies aim to tackle their space utilization challenges and target improvement in picking and handling processes.

Core goals for the upcoming year extend to increased profitability, decreased costs per order, real-time inventory visibility throughout the supply chain, streamlined order fulfillment cycle times, and upgrades in order-picking technology. This collective focus reflects the industry's commitment to achieving both financial gains and operational excellence.

Expected Challenges for Warehouse Operations

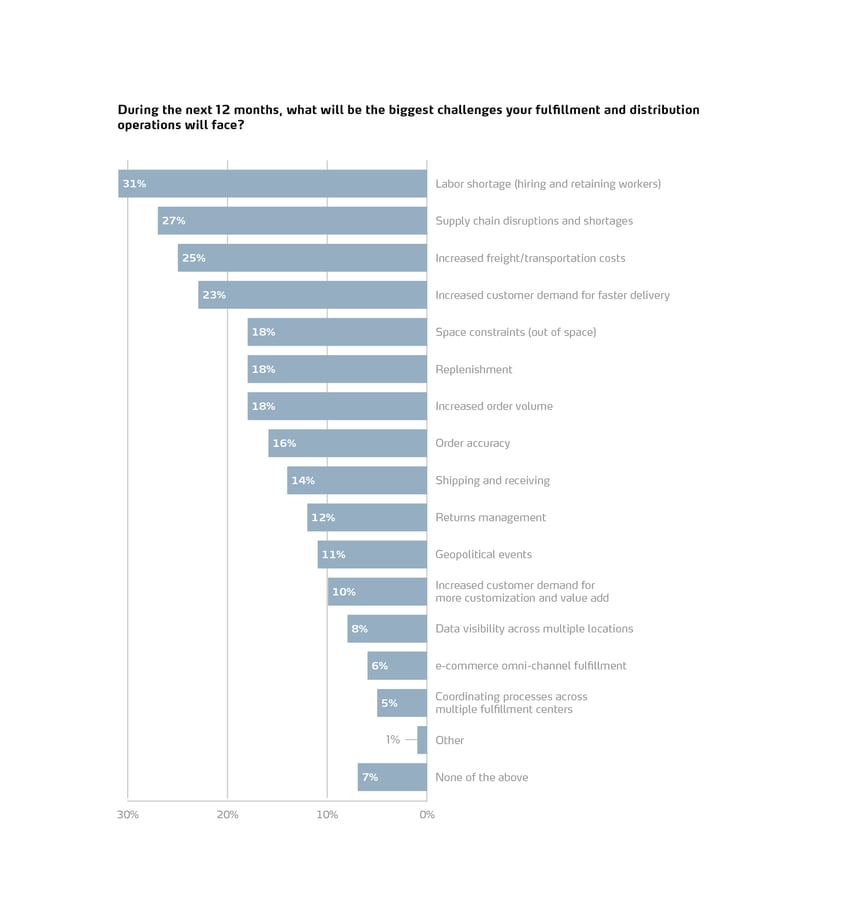

To no one’s surprise, warehouse labor reigns supreme as the top challenge for order fulfillment and distribution center managers. It’s also no surprise to see supply chain and freight costs continue to keep them up at night as well while the world recovers from the lingering aftershocks of the COVID-19 disruptions. As if that wasn’t enough, customer demand for faster delivery continues to trend upwards as more consumers’ e-commerce delivery time expectations continue to balloon and the “big fish” drive delivery times down.

The challenges don’t end there. Companies also expect to deal with replenishment issues, higher order volumes, the need for better order accuracy and ongoing returns management pain points. For at least one respondent, "convincing corporate that we need to move into the 21st Century in warehousing” is the biggest roadblock.

Comparing these results with the current challenges that warehouse and DC operators are dealing with—hiring and retaining workers; supply chain disruptions and shortages; higher freight and transportation costs and increased customer demand for faster delivery—it’s clear that companies expect many of 2023’s top challenges to roll over into 2024.

So, What's the Plan for Warehousing?

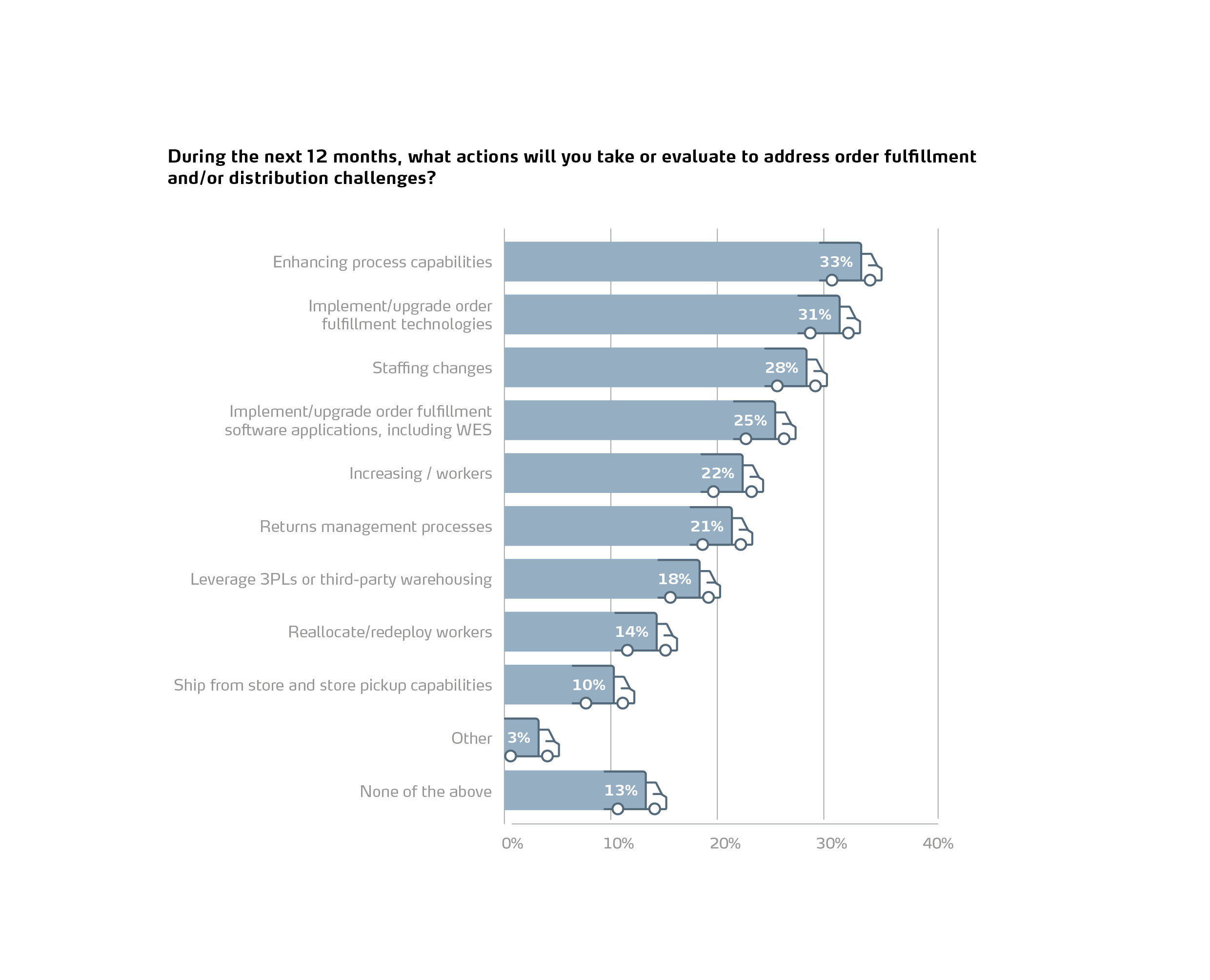

Moving into 2024, companies will tackle their order fulfillment and distribution challenges by enhancing their process capabilities, leveraging warehouse automation by implementing or upgrading order fulfillment technologies, make staffing changes, or implementing/upgrading their order fulfillment software.

To deal with the new order fulfillment and distribution realities, companies also plan to hire more employees, improve their returns management processes, work with more third-party providers, redeploy workers to different jobs or improve their ship from store and store pickup capabilities.

Technology and warehouse automation will continue to play an increasingly important role in the modern order fulfillment or distribution environment.

Specifically, organizations plan to implement WMS/WES/WCS software (18%), radio frequency picking technology (17%), conveyor and sortation systems (15%), robotic cube storage (12%), AMRs (12%) and AGVs (11%), and ASRS including vertical lift modules, vertical carousels, and vertical buffer modules (9%). Companies also plan to evaluate and implement more mini-load/unit-load systems and pick-to-light technology.

|

According to the survey, 40% of companies plan to further invest in additional automation systems and technologies or add to their existing systems during the coming year.

Christina Dube Director of Marketing, Kardex Remstar |

|

As companies find ways to meet current demands while also future-proofing their fulfillment operations, they’re increasingly looking for ways to incorporate warehouse automation into their operations. Focused on streamlining processes, improving labor utilization, increasing throughput and improving customer satisfaction levels, organizations that make this move now versus later will be best positioned for success.

Download the full survey results here in our 2024 Warehousing Industry Report